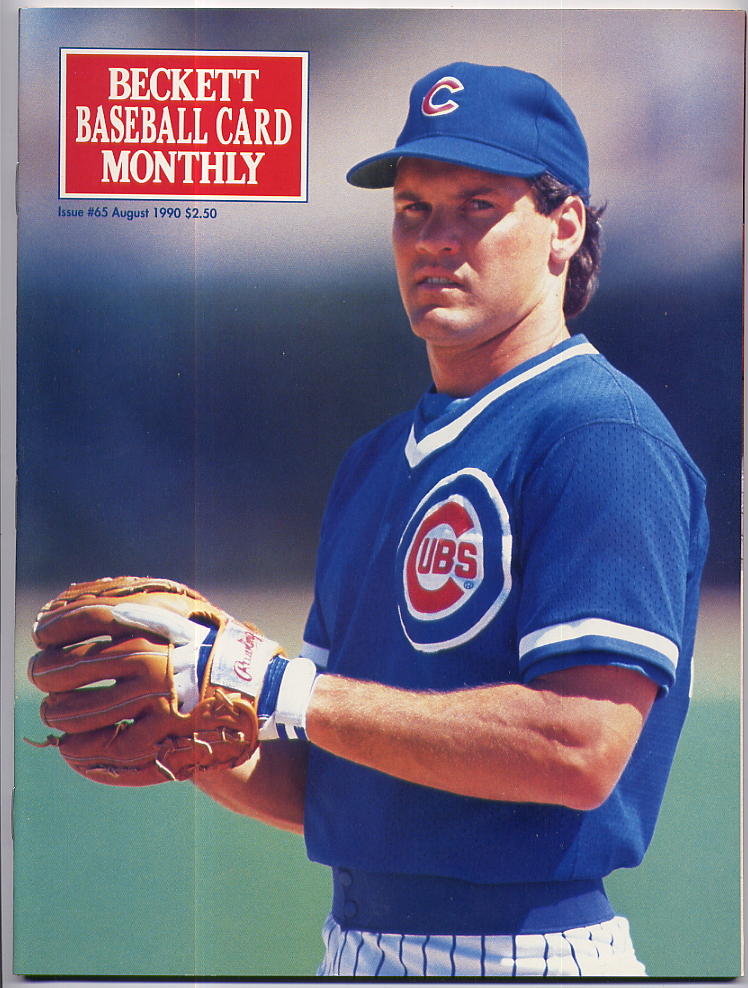

Lesson 1: Informational advantages matter especially when trading with serious kids, err ahh I mean counterparties. As a boy, I traded baseball and basketball cards with other kids. We took it seriously. They were all well informed about the values of the cards we would trade. I’m not saying this was ethical, or that I’m proud of it, but one of my moves was having a friend over just after the latest Beckett Baseball Monthly (Beckett) was released–in this case the one with Ryne Sanberg on the cover. I’d memorize the largest increase or decreases in the value of the cards that the kid I would be trading with owned in order to formulate my list of what I wanted from them and what I wanted to trade to them. Then, I’d stash the new copy of Beckett.

I’d put the previous month’s issue in the corner of my bedroom–in this case the one with Ken Griffey Jr. on the cover. They would then come over to my house and we would begin trying to put a trade together. For example, if I got together with a classmate in early August, I’d focus on the cards they owned that had gone up in value the most between July and August. Inevitably at some point, as we traded cards, the other kid would want to reference Beckett and would see my (slightly dated) copy in the corner. They’d pour through the numbers and we’d strike a deal that looked good, at least based on the last month’s values.

How does this apply to real estate? Some of the best deals I have done have involved trading with uninformed counterparties. Many of these inefficiencies however are fleeting, and therefore they aren’t uninformed for long. When CA passed new ADU-related legislation, there was a period of time before legacy owners became informed counterparties.

Bottom line: you’ve got to be ready to strike when there’s a sudden shift in value.

Lesson 2: it’s better to avoid serious counterparties or better yet avoid those with financial motives.

Children in my generation were attracted to baseball cards in part by the great money that people had made from cards manufactured in the 1950s-70s. Much of this money was made because so few cards were stored carefully, or even kept! But a lot of this money was also made trading against totally indifferent and uninformed counterparties. Think like a parent that is selling his college-age child’s card collection in the 1970s for a song at a garage sale. By the time I got into the market, lured by these types of stories, there were no longer totally uninformed counterparties.

As real estate investors, we want to find counterparties that either don’t know the potential value of what they have or whose primary goal isn’t getting “top dollar.” I’ve bought plenty of homes and apartments from people who have a larger bigger issue in their life that is more important than getting top dollar for their property. These are counterparties whose priorities are different and whose goals are not strictly financial.

I’ve also bought properties from people that don’t recognize their property’s potential. While I’ve outgrown stashing the latest pricing information out of sight of my counterparty, I’m not so enlightened that I’m game for sharing rezoning or recent state legislative changes with them either.

Did you enjoy this article? You can share on Twitter by clicking HERE

Recent Comments