Inefficient PursUITS

My name is Bob Flynn. I’ve been in the investment business for nearly twenty years. Here at the inefficient pursuits blog you can join me on my journey to identify inefficient asset classes & inefficiently priced or mispriced assets. Join us and get my free weekly newsletter.

A Better Investment Process

For insights into how each deal should express your view of the world.

RESIDENTIAL REAL ESTATE

We seek to identify less competitive residential real estate markets where one is paid for providing quick access to capital

COMMERCIAL REAL ESTATE

We evaluate and report on the inefficiencies within several sub institutional scale commercial real estate property types

LENDING mARKET

We explore whole loans secured by real estate. This includes both newly originated loans and secondary market purchases of loans

Why Invest In Inefficient Asset Classes?

For the experienced and informed investor the answer is simple: greater returns per pound of risk. Though we expect to explore several inefficient asset classes, we will initially look at residential and commercial real estate. Both broad asset types have a number of hallmarks of inefficient markets. They reward informational asymmetries, have high levels of both search and transactional costs, have fragmented decentralized markets, are heterogenous (literally no two buildings are the same), trade with varying levels of liquidity, are valued on a lag (via appraisals), and display return momentum/predictability. If your curious what this is all about and why it matters, you are in the right place.

Most Popular Articles

Making Markets…in Senior Community Condos

Today, in January 2020, we are in a market with a lot of skinny deals. Thin margins with a lot of hope embedded in the purchase prices are common. Liquidity is abundant meaning you rarely get paid for providing it. This is one reason why I'm sourcing performing loans...

Real Estate Sum of the Parts Deals, Not Your Typical Value Traps

I’ve seen hundreds of stock pitches that present a company with a hodgepodge of different assets and operating businesses, some of which have no reason to be under the same roof. They’re often valued on a sum of the parts basis based on comparative metrics for the...

Trading Cigar Butts & Deferring Taxes

Show a little faith, there's magic in the nightYou ain't a beauty, but, hey, you're alrightOh, and that's alright with me-Bruce Springstein "Thunder Road" Today I will discuss small deals that aren't beauties. I will show that: You can start small in real estate...

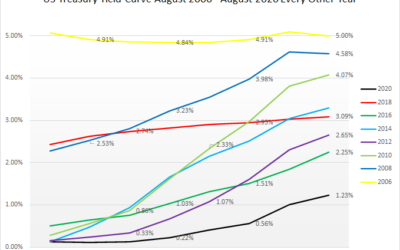

At The Zero Bound – Lend Short, Borrow Long

The Risk Free Rate of return underpins the value of trillions of dollars of assets. As the “risk free” return edges lower, it induces us to purchase risk assets requiring higher expected returns. Because the Dollar is...

Private Lending–Investing In An Uncertain World

As I write this in the summer of 2020, considerable downside risk exists for asset values over the next 12-18 months. COVID-19 rages across the world with America making up an outsized percentage of cases per capita. Besides the enormous human toll, it has also laid...

Pursue Inefficiently Priced Assets With Me

Get our newsletter delivered to your inbox once a week. Nothing else. No SPAM.