Inefficient PursUITS

My name is Bob Flynn. I’ve been in the investment business for nearly twenty years. Here at the inefficient pursuits blog you can join me on my journey to identify inefficient asset classes & inefficiently priced or mispriced assets. Join us and get my free weekly newsletter.

A Better Investment Process

For insights into how each deal should express your view of the world.

RESIDENTIAL REAL ESTATE

We seek to identify less competitive residential real estate markets where one is paid for providing quick access to capital

COMMERCIAL REAL ESTATE

We evaluate and report on the inefficiencies within several sub institutional scale commercial real estate property types

LENDING mARKET

We explore whole loans secured by real estate. This includes both newly originated loans and secondary market purchases of loans

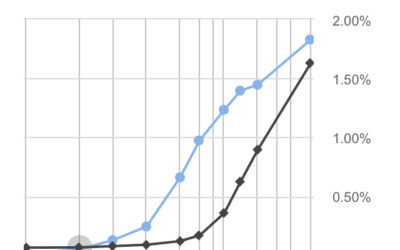

Why Invest In Inefficient Asset Classes?

For the experienced and informed investor the answer is simple: greater returns per pound of risk. Though we expect to explore several inefficient asset classes, we will initially look at residential and commercial real estate. Both broad asset types have a number of hallmarks of inefficient markets. They reward informational asymmetries, have high levels of both search and transactional costs, have fragmented decentralized markets, are heterogenous (literally no two buildings are the same), trade with varying levels of liquidity, are valued on a lag (via appraisals), and display return momentum/predictability. If your curious what this is all about and why it matters, you are in the right place.

Most Popular Articles

Who I Want to Lend to

In my niche of lending to investors in single family residences and 2-4 unit properties, there are a few different types of borrowers. They can be segmented based on the type and volume of deals they do. Typical deal types are: Fix and FlipsBRRR Deals –buy, renovate,...

Non Performing Loans: Trade Construction, Adverse Selection & Marshmallows

I’ve previously discussed purchasing a basket of nonperforming second mortgages a few years ago. Below is a discussion of the reasoning behind the trade. My hope is this will begin to help you better understand how I broadly think about trade construction as...

Abracadabra Portfolio

I recently read James Rickards book: The New Great Depression, Winners and Losers in a Post Pandemic World. Rickards lays out his portfolio allocation for this current time period, what he calls the New Great Depression. Here’s the portfolio: While I personally try...

Hard Money Loans—shelter from the storm

We had a loan payoff last Friday that underscores my post COVID business plan. First some context: I began to (again) make hard money loans for a few reasons when COVID hit my radar. As the Fed pumped liquidity into the system, real yields on risk assets collapsed. ...

What Baseball Card Collecting Taught Me About Real Estate Investing

Lesson 1: Informational advantages matter especially when trading with serious kids, err ahh I mean counterparties. As a boy, I traded baseball and basketball cards with other kids. We took it seriously. They were all well informed about the values of the cards we...

The Equity Yield Curve in Private Markets

Like many, I belatedly came across the Nomad Investment Partnership letters this past year. Nick Sleep’s idea of an equity yield curve rings true to me and is consistent with my experience. For those unfamiliar, the idea is that “patience has a value, and that...

The Money Trust is Dead, Long Live the Money Trust

I´m a community bank guy. Ok, ok yeah I worked for Citigroup for a bit in my 20's, but at heart I am a community bank guy. I recently took a small long position in my personal account in County Bancorp, Inc. (ICBK). Nicolet Bankshares, Inc. (NCBS) is...

Pursue Inefficiently Priced Assets With Me

Get our newsletter delivered to your inbox once a week. Nothing else. No SPAM.